Bitcoin is too volatile, but that’s the price of it being open and fair

The recent BTC price drops, though huge and highly publicized, are nothing new in the history of bitcoin.

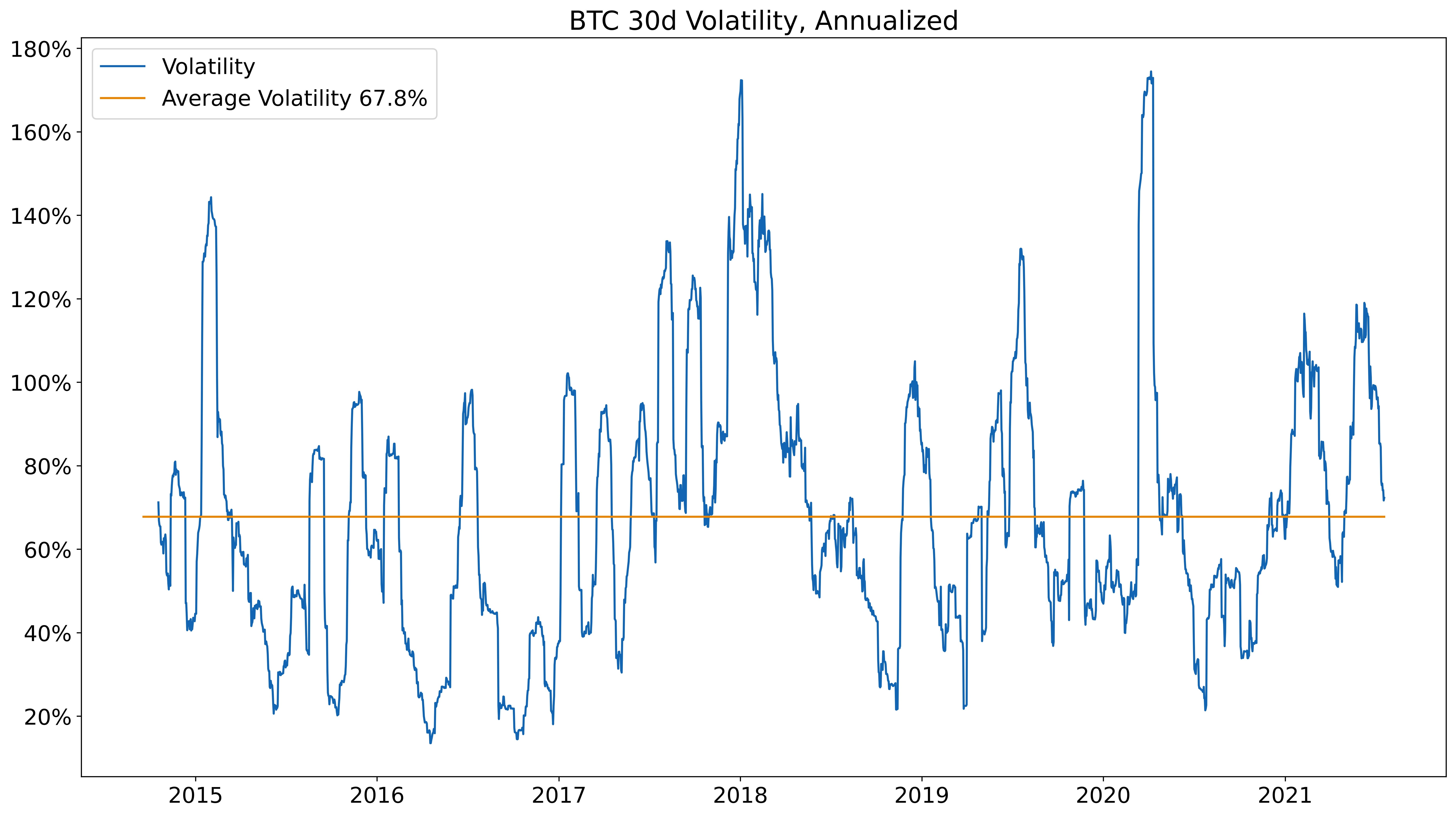

Looking at the past 5 years of price data for bitcoin, you can see that price has remained quite volatile despite growing several orders of magnitude in market capitalization over the same period.

It’s interesting to read old Quora and Reddit threads from 2014–2017, where many observers said they expected volatility to reduce as bitcoin market cap and daily trading volume grew. This expectation was logical, yet it hasn’t transpired — why not? And does continuing volatility reveal a flaw in bitcoin itself?

To answer this question, let’s look at a quick comparison of volatility in the regular stock market.

An antiquated model for controlling volatility

In traditional markets, regulators spend a vast amount of time, money, and energy limiting the amount of volatility. This is for good reason, as large price swings can destroy the portfolios of everyday investors (which is **bad for *all participants *in the long term).

On the NYSE, circuit breakers can be triggered after a 7%, 13%, or 20% intraday move. However, these circuit breakers are more often than not triggered when the price moves to the downside (or on the upside when a large wall street institution is stuck in a short squeeze).

Level 1 halt (7%)

-

Trading will halt for 15 minutes if drop occurs before 3:25 p.m.

-

At or after 3:25 p.m. — trading shall continue, unless there is a Level 3 halt.

Level 2 halt (13%)

-

Trading will halt for 15 minutes if drop occurs before 3:25 p.m.

-

At or after 3:25 p.m. — trading shall continue, unless there is a Level 3 halt.

Level 3 halt (20%)

- At any time during the trading day — trading shall halt for the remainder of the trading day.

NYSE trade halts historical data can be found here.

If Bitcoin were traded on the NYSE, a circuit breaker would be triggered each time the daily percent change is < = -7% (the red line on the chart), i.e., many times per year.

If Bitcoin were traded on the NYSE, a circuit breaker would be triggered each time the daily percent change is < = -7% (the red line on the chart), i.e., many times per year.

Here’s the same chart for the S&P500 for comparison. Circuit breakers were triggered on March 9th and March 12th, 2020.

Here’s the same chart for the S&P500 for comparison. Circuit breakers were triggered on March 9th and March 12th, 2020.

Looking at the red line, the S&P500 is a much safer place to be than bitcoin, right?

Well, maybe and maybe not.

A cost of stability is a lack of fairness

Most of the methods of controlling price volatility employed by traditional exchanges are not necessarily there to protect individual investors as much as institutional investors. The arbitrary focus on 3.25pm as a cut-off point (very convenient for American participants who’ve come back from their lunch break) gives a hint of this, but the recent Gamestop saga provides a more detailed illustration.

On January 22, Robinhood froze Gamestop (GME) stock purchases on their platform and then later limited the amount of shares users could buy. AMC Entertainment (AMC), BlackBerry (BB) Nokia (NOK), and several other stocks that were part of the Wall Street Bets short squeeze were also affected.

At one point Robinhood only allowed investors to sell their stock in Gamestop and limited purchases to one share per user. Quite a strange thing to do for a company that claims to enable “investing for all”.

Apparently lofty claims about democratizing investing don’t apply when Robinhood’s largest customer, Melvin Capital, is stuck in a short position in GME during a short squeeze, such that any large purchasing of GME shares would make its situation worse.

The Gamestop story is just one illustration of how investing in traditional markets is broken for individual or non-pro traders. There’s simply too much arbitrary regulation, too many middlemen, and far from enough decentralization.

If this is what volatility control looks like, then we do not want it.

(Note: I’m deliberately not covering stablecoins in this article, the most mainstream of which — USDT and USDC — only achieve stability at the cost of relying on centralized and off-chain collateralization to a fiat currency that is itself centralized and off-chain, which is totally different to how bitcoin works.)

A cost of freedom is easy access to excessive leverage

Although also imperfect and guided by incentives that do not align with those of private investors, centralized cryptocurrency exchanges are a step in the right direction towards leveling the playing field between everyday investors and large financial institutions — simply due to the fact that they’re trading in cryptocurrencies rather than fiat ones.

What makes centralized cryptocurrency exchanges great is that they are generally open 24/7, have relatively low fees, and thanks to the decentralized nature of cryptocurrencies, no one can halt the trading of a cryptocurrency. Implementing a circuit breaker on a cryptocurrency exchange would go against the financial incentives of the exchange, and would potentially open up arbitrage opportunities for traders on other exchanges.

On the other hand, cryptocurrency exchanges do play a role in amplifying or increasing volatility — perhaps artificially — and this is because of margin trading (aka, leveraged trading, or placing bets with borrowed money).

The issue of margin trading is core to cryptocurrencies themselves, as it connects back to their lack of supervision. And it begs the question: is excessive volatility due to bitcoin users straying from the principles which led to the creation of bitcoin in the first place?

What would Satoshi think of all this hyper-leveraged trading?

In Bitcoin’s genesis block, Satoshi encoded a message that references The Times article, Chancellor on brink of second bailout for banks.

The financial crisis of 2007–08 was exacerbated by too much leverage in the banking sector. When a correction came, triggered by bad financial derivatives based on sub-prime mortgages, over-leverage created a domino effect that turned this correction into a crash. Many banks failed, while others received vast government bailouts. Ordinary people are still paying the price for this today.

It was from the depths of the 2008 financial crisis that the first blockchain-based digital currency, bitcoin, was born. At its core, bitcoin was designed to act as a fairer alternative to fiat currency in which ordinary people’s wealth could be better protected from processes outside of their control — hence that embedded historical reference to the bailout.

An excellent tweet by Naval:

Bitcoin is a tool for freeing humanity from oligarchs and tyrants, dressed up as a get-rich-quick scheme.

— Naval (@naval) January 24, 2018

Centralized cryptocurrency exchanges have capitalized on the idea of cryptocurrencies as a “get rich quick” scheme by allowing investors to maximize their profits *(or losses) *by trading on margin — in other words, doing exactly what the banks did in the run-up to the financial crisis.

This of course overlooks the more long term (and safer) reason for investing via crypto exchanges, which is to use your spare capital support blockchain projects you think will do well and grow in value.

Some centralized exchanges allow users to trade up to 75X, 100X, and even 125X margin. This is almost begging for a cycle of boom and bust, because leveraged trading, especially coming from the retail side, accentuates price volatility in cryptocurrency markets.

The recent large price drop of bitcoin wasn’t necessarily the fault of Elon Musk saying that Tesla would stop taking Bitcoin as a form of payment, or the news of China cracking down on cryptocurrencies, but the two events were instead the first set of dominoes to set off a mass liquidation event of investors trading on highly leveraged positions.

Remember, for centralized exchanges, large liquidation events are when they make the most profit. This warped system of incentives is one mechanism that drives large price movements in cryptocurrency markets. These large price movements can hurt not only those risk-taking margin traders but also regular HODLers who never used leveraged positions. Not very fair, right? On the other hand, without all the margin trading, the bitcoin price might not have risen so high in the first place.

We have to learn to live with volatility, because it comes from us

*The upshot: *Volatility in cryptocurrencies can be seen as intrinsic to the space, as it reflects the absence of the controls and arbitrary rules that make traditional investing so unfair. At its best, volatility is *useful *for at least some crypto users — otherwise everyone would have switched to stable coins instead. At its worst, volatility is an unfortunate byproduct of over-leveraged trading and therefore a price we must all pay to be free of government monetary control.

It’s ironic that a community that so often criticizes the traditional financial industry for not being able to use leverage responsibly is similarly unable to show restraint. Clearly, this is something that stems more from human nature rather than from any fundamental problem with traditional markets, and bitcoin is certainly no antidote to it.

At BR Capital and our trading arm T-Digital, we use leveraged positions as a matter of course. However, we have a team of >30 people, backed by machine learning and other algorithms, who are constantly working towards getting the correct balance of maximizing returns while managing risk (and there is plenty of risk). The idea of retail investors making highly leveraged bets without this support is something we find quite scary. This is one reason why we’re investing in derivatives exchanges, such as Delta Exchange, that can help all crypto users to better insure themselves against volatility.

If you enjoyed this article please subscribe to Crypto Insights by BR Capital.

What do you think about the role of centralized exchanges and margin trading in price volatility? Feel free to leave your thoughts below.

All charts in this article can be found here.